- DCM Shriram commissions new caustic soda plant, boosting capacity at Jhagadia to 900 TPD

- Atlas Copco Tools unveils Smart Factory Innovation Centre in Pune

- Paras Defence signs an MoU with Israel's MicroCon

- Yudo launches industry-first training programme to upskill India's plastic manufacturing workforce

- Godrej Enterprises Group partners with EOS to enhance 3D Printing for Aerospace Manufacturing in India

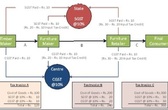

Taxing transaction under CGST & SGST

Both would be levied on the same price or value unlike State VAT which is levied on the value of the goods inclusive of Central Excise.

Proposed registration procedures under GST

Existing tax payers will not have to apply afresh for registration under GST

Key features of proposed payment procedures under GST

Focus on going digital and ‘ease of doing business’

How will GST be implemented in the country?

Both Centre and States will simultaneously levy GST across the value chain

These taxes are being subsumed into GST

Find out which taxes you don’t have to pay anymore!

What are the benefits of GST?

Find out how GST will benefit the industry, the governments and the consumers.

Goods and Services Tax (GST) Simplified!

It is a step ahead for ‘Nation’s Good’ and Nation’s Service!

ExxonMobil is official lubricant partner for Micromatic Machine Tools

To enable manufacturing customer achieve higher productivity and sustainability goals

Indian economy to play an instrumental role

Tomohiko Okada, Managing Director, Toshiba India Pvt Ltd (TIPL) says, infrastructure growth in India is pivotal and requires a major overhaul to meet the exponentially increasing domestic...