The Indian economy has slowed over the last few quarters. The GDP growth rate for the first half of the current financial year i.e. April to September 2013 is estimated at 4.8 percent. Industrial production has been severely impacted during this period and the IIP has contracted by about 0.2 percent in the April-November 2013 period over the previous year. It was expected that GDP growth may be slightly higher in the remainder of the year.

Factors such as easing of tensions in the Persian Gulf, a stabilising exchange rate, improved foreign exchange reserves and reduced current account deficit, would have supported this improvement. However, consumer inflation remains stubbornly high, and the outcome of the recent assembly elections and upcoming general elections, as also the impact of the US Federal Reserve's tapering of bond buying, create uncertainties at least for the next 18 to 24 months. For the full financial year 2013-14, India's GDP growth is unlikely to be above five percent.

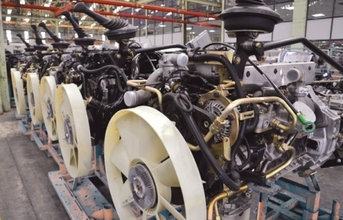

Slowdown in Motown

The Indian automotive industry has been badly hit by the economic slowdown. Domestic sales of almost all vehicle classes grew at higher than ten percent annually between FY09 and FY12 but have been sharply impacted over the last two years. From April to December 2013, 2.3 million passenger and commercial vehicles were sold, nine percent lower than the same period last year. Of these, medium and heavy goods trucks saw the worst dip, of almost 30 percent, impacted by lower economic activity and high interest rates. Utility vehicles had done well in the summer, but volumes dropped later and the period's sales are four percent lower than last year. From the point of view of auto component manufacturers, the bright spot has been slightly better vehicle export volumes, and a five percent rise in two-wheeler sales to 11 million, helped by a 20 percent rise in scooter sales.

| Emerging trends | Challenges for suppliers |

(emissions and safety)

|

|