- Polymatech Electronics Enters High-Power UV LED Manufacturing

- "We Plan on Doubling Every Year"

- India Eyes a @25 Trillion Manufacturing Future by 2047

- Kennametal to Showcase Advanced Earth Cutting Tools and Wear Protection Solutions at EXCON 2025 in Bengaluru

- IMTEX Forming 2026 Set to Shape the Future of Manufacturing

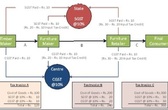

Taxing transaction under CGST & SGST

Both would be levied on the same price or value unlike State VAT which is levied on the value of the goods inclusive of Central Excise.

Proposed registration procedures under GST

Existing tax payers will not have to apply afresh for registration under GST

Key features of proposed payment procedures under GST

Focus on going digital and ‘ease of doing business’

How will GST be implemented in the country?

Both Centre and States will simultaneously levy GST across the value chain

These taxes are being subsumed into GST

Find out which taxes you don’t have to pay anymore!

What are the benefits of GST?

Find out how GST will benefit the industry, the governments and the consumers.

Goods and Services Tax (GST) Simplified!

It is a step ahead for ‘Nation’s Good’ and Nation’s Service!

Ready to deal with short & medium term effects of Brexit: FM

Immediate and medium-term firewalls are solid too in the form of a healthy reserve position.

GST roll out infrastructure is ready: EA Secretary

However, besides passage by Parliament, it also requires ratification by at least half the number of the State Assemblies.