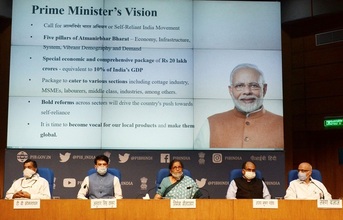

On the evening of May 13, 2020, India's Finance Minister Nirmala Sitharaman has announced relief measures for businesses, especially MSMEs to support Indian Economy's fight against COVID-19. This is in line with the Prime Minister's promise of a mega economic package worth Rs.20 lakh crore, which is equivalent of ten percent of the country's GDP. The PM's call for a self-reliant India has been very well articulated in the FM's relief measures that comprehensively address the five pillars of self-reliance - Economy, Infrastructure, System, Vibrant Demography and Demand.

"Essentially, the goal is to build a self-reliant India that is why the Economic Package is called Aatma Nirbhar Bharat Abhiyaan (Sel-reliant India movement)," the FM said. Sitharaman highlighted that the announecd measures focus on ‘Getting back to work' i.e., enabling employees and employers, businesses, especially Micro , Small and Medium Enterprises, to get back to production and workers back to gainful employment. Efforts to strengthen Non-Banking Finance Institutions (NBFCs), Housing Finance Companies (HFCs), Micro Finance Sector and Power Sector were also unfolded. Other than this, the tax relief to business, relief from contractual commitments to contractors in public procurement and compliance relief to real estate sector were also covered.

Powering the engine

The Indian MSME sector is the second largest in the world (after China). The contribution of the MSMEs to the Indian economy has always been remarkable; many times, it is refered to as the engine of growth for the Indian economy. Unfortunately, Indian MSMEs have been hit very hard by the Covid-19 pandemic and the mega economic package by the Government of India definitely clears the way for liquidity infusion, thereby giving them the necessary handholding. Today, most MSMEs are in dire straits and waiting to revive their businesses; this mega package will surely provide them with the required stimulus. For example, the Rs. three lakh crore Emergency Working Capital Facility for Businesses, including MSMEs will provide a huge relief to them. According to the package, additional working capital finance of 20 percent of the outstanding credit as on 29 February 2020, in the form of a Term Loan at a concessional rate of interest will be provided. This will be available to units with upto Rs. 25 crore outstanding and turnover of up to Rs 100 crore whose accounts are standard. The units will not have to provide any guarantee or collateral of their own. The amount will be 100 percent guaranteed by the Government of India providing a total liquidity of Rs. 3.0 lakh crore to more than 45 lakh MSMEs.

Welcomed by the industry

Venu Srinivasan, Chairman, TVS Motor Company has welcomed the mega package calling it comprehensive and highly progressive. "The announcement of Rs. three lakh Crore collateral-free automatic loan is an exemplary move to boost the industry sentiment. This will augment liquidity and help MSMEs revive the business during these challenging times. The large credit guarantee will be a great step to restore the supply chain which was heavily impacted by the shutdown. The massive fiscal stimulus will help improve the impacted financial system and the positive business perception will stimulate demand. These measures will kick-start financial activity and help rebuild the economy during the pandemic," he said.

The bold steps taken by the government of India in order to provide assistance to the MSMEs is highly commendable, said Anand Srinivasan, MD, Covestro India. "It is a visionary package and will help the industry to regain and revive and we are looking forward to more such announcements over the next few days. The decision of redefining the definition of MSMEs is more inclusive and will distribute benefits to many," he added.

Mehernosh Tata, the Head of Edelweiss SME Lending believes the measures announced by the Finance Minister will go a long way in lifting the sentiments and morale of the MSMEs. "The package has been extremely well thought, both from a sustenance and liquidity point of view. The announcement of payment of receivables within 45 days to all MSMEs, by the Government of India and CPSEs, will provide requisite liquidity in the hands of entrepreneurs. Restricting tenders less than Rs. 200 crore only to Indian entities, provides a great opportunity for MSMEs to get incremental work orders, especially when demand may slump in the near future," he explained.

Naveen Soni, Senior Vice President, Sales & Services, Toyota Kirloskar Motor has welcomed the message for India to be self-reliant and the need to introduce strong reforms, which will further strengthen the Indian auto industry. "The stimulus package is comparable with the measures taken globally and will definitely boost morale of the stressed sectors and industries, especially the MSMEs. Furthermore, the reclassification of the MSME sector, based on investment and turn over will open up various enterprises to remain as MSMEs, aiding cash flow with collateral free loans. The Government is taking measures to boost the supply side of the economy and we now await their support to boost the demand side where government spending can boost a faster revival of the economy," he noted.

On the closing note

The Machinist welcomes the fact that the mega economic package details shared by the finance minister clearly show the focus is comprehensively on the MSMEs who have been adversely hit by the Covid-19 outbreak. The package also shows the government's positive intent to both support the country's small businesses and also to provide them with an opportunity to avail these relief measures to survive, sustain and grow.

It is indeed remarkable that the Indian Government is endeavouring towards reviving the economy in order to make it self-reliant and self-resilient.

By availing this mega economic package new stimulus and the likely reforms, Indian industry will be able to overcome the bottlenecks related to liquidity, supply chain, demand, labour related issues. The package will revive the country's economy in an effective manner. It is quite likely that the Indian industry will have to function alongside the Covid-19 pandemic for a fairly long time, but this mega package will go a long way in resuming business operations while safeguarding the health and safety of all stakeholders. It will certainly support in helping the key components of the economy and also enable in building demand in Lockdown 4.0.

END